The Pendulum Effect

Wrecking havoc with each and every swing

During the onset of the pandemic, most of us didn’t realize how much the world was about to change. As paranoia spread, so did erratic global supply and demand shifts.

Instead of 100 options for your next dollar, there were only 20 options remaining. Historically diversified demand preferences became concentrated on a few select industries as the general population served a blanket house arrest order. Buying furniture became next to impossible. Want a dog to keep you company? Good luck. Nintendo Switch shortages across the world. Remember that pool you were thinking about installing?

Meanwhile, other industries experienced the polar opposite effect. Theatres sat empty, carnivals closed, flights cancelled. Frankly, our supply chains weren’t built to withstand such dramatic changes.

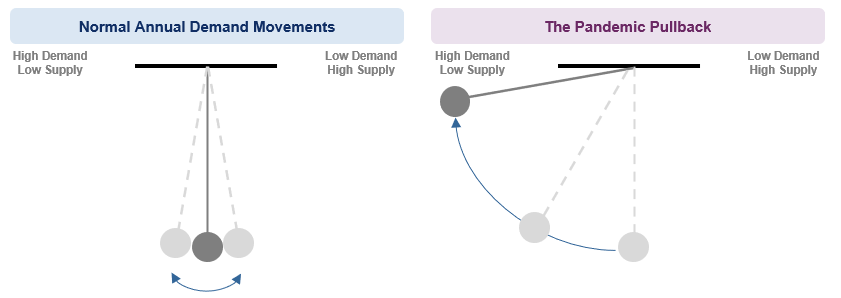

In normal times, the pendulum sways slowly back and forth. Supply chains slightly overestimate demand one year, the next is slightly underestimated. The harm is negligible as supply chains are priced to withstand such subtle movements year over year.

The Pandemic Pullback

On one side of the pendulum, we see an industry that has too much demand relative to its scarce supply levels. On the other side of the pendulum, supply greatly outweighs the very limited demand. In the middle, we have perfect balance.

An issue arises when the demand pendulum is wound up significantly beyond expectations. Our world is only built to operate within 10 degree movements to the left or right. The pandemic pulled the weighted ball back 30 degrees within a month, and has continued to pull the ball back another 50 degrees over the past year. Demand is currently highly concentrated on very few industries - most of which are struggling to meet the exorbitant levels of enthusiasm.

Pictured Above: Several industries have experienced significant demand spikes but supply chains cannot service the full extent of the demand. Industries such as airlines or resorts currently see the pendulum pulled to the far right.

The Drop and Swing

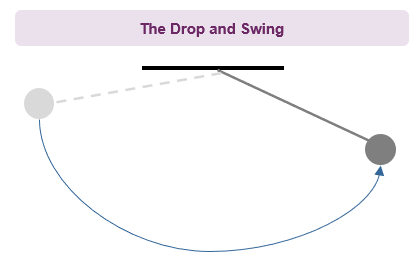

Once the ball drops, when the general economy reopens, a massive shift in demand preferences occurs. Deprived of social experience, people stop buying furniture and puppies. Gawking eyes become fixed on concerts, travelling, dining, clubbing, and socializing at all costs. The pendulum swings.

While this is clearly fantastic for our general being and mental health, it is highly disruptive on an economic level. Popular pandemic purchases seemingly freeze overnight. The issue here is that there are likely many supply chains which have greatly increased capacity to appease the heightened demand. This extra capacity becomes unused, as well as a significant portion of the “pre-pandemic” capacity, burdening the supply chain with significant costs. Some companies may buckle under the evaporating demand.

On the other hand, industries which have been starved of demand now face starving demand. Many businesses have closed due to the pandemic in the entertainment and travel industries, thus supply is contracted versus “pre-pandemic” levels. These damaged supply chains are about to face the wrath of pent-up demand, meaning prices will skyrocket due to scarcity. These industries are about to drink from a firehose.

Pictured Above: As demand preferences dramatically change, the pendulum swings to the far right and popular pandemic industries suffer overcapacity issues. Industries such as airlines or resorts see the pendulum simultaneously swing to the far left.

The Period of Oscillation

Its clear to see how the pandemic will continue to terrorize the supply chain equilibrium for quite some time. The question is what happens after the first swing? What happens after the pent-up social experience demand slows down?

My general theory is that we will continue to see these waves of demand shifting from industry to industry, decreasingly potent. For example, furniture purchases for many households have been pulled forward one to three years as we look to improve our cozy jail cells. This means that once the economy reopens, the industry may experience a massive pullback (which is to be expected). As stock goes unsold for a year or two, you may begin to see some heavy discounts which then pulls forward more demand. Over time, this oscillation stabilizes, but in the near term each swing can massively disrupt operations.

Its important to remember that each industry experiences these oscillations differently. Someone who installed a pool needs to constantly maintain it. This means an industry like pool consumables will have permanently increased demand as the pool install base dramatically increased during the pandemic. While pool installs in the next few years may flatline, the pool consumables industry doesn’t need to worry about demand evaporating overnight. They just need to worry about the previous high-water mark.

If you enjoyed reading this article, feel free to subscribe below or share it with some friends - it is highly appreciated:

If you have any comments about the content, you can shoot me an email at rcmcdiarmid@gmail.com or find me on twitter @rcmcdiarmid. More than happy to adjust the content above if anyone brings a new viewpoint to the table.